Timeline

March 2022

Role

UI/UX Designer

Tools

FIGMA, Adobe PHOTOSHOP, Adobe Illustrator

Overview

H&R Block, a leading tax preparation company, partnered with CoinTracker, a cryptocurrency portfolio tracker, to make it easier for people to file their crypto taxes. The partnership allows H&R Block customers to import their crypto transactions from CoinTracker, which automatically calculates their capital gains and losses. This saves time and reduces the risk of errors.

I worked with a content writer and project manager to integrate CoinTracker into H&R Block's tax product. We worked closely with both teams to ensure that the integration was smooth and seamless. The result is a solution that makes it easy for people to file their crypto taxes accurately and efficiently.

Problem

H&R Block did not have a way to collect multiple cryptocurrency investments from its users and generate a Form 8949 for them. Form 8949 is a summary of cryptocurrency investments that is submitted to the IRS during tax filing season.

Cointracker is a tool that helps users funnel their cryptocurrency portfolios from different investment apps into one document that can be used with H&R Block's tax product.

Constraints

Cryptocurrency Tax Mistakes Could Cost YOU $250,000

〰️

Cryptocurrency Tax Mistakes Could Cost YOU $250,000 〰️

Tight deadline: H&R Block needed to integrate CoinTracker into its tax product before the end of the tax filing season deadline, which is in April. This gave us a very limited amount of time to complete the project.

Limited engineering resources: Due to the tight deadline, the engineering team had to focus on the most critical aspects of the integration. This meant that some features were unintuitive and required manual data input.

Legacy system: H&R Block's tax product is a legacy system, which made it challenging to integrate with CoinTracker's modern API.

Solution

The solution to the problem was separated into phases. I was involved in phase 1 of the project.

Phase 1:

Integrate Cointracker in the DIY flow into existing products.

Add a call to action (CTA) was added to the DIY App to navigate users to the CoinTracker landing page, where users could download the 8949 form.

This phase allowed users to track their cryptocurrency transactions in CoinTracker and then manually enter the taxable transactions into the DIY product. This solution was feasible because it did not require any changes to the DIY product Legacy systems.

Paper Research

The Costly Complexity of Crypto Taxes

Preliminary research has shown that American citizens are losing thousands of dollars annually due to the complex tax laws surrounding cryptocurrency. The IRS classifies cryptocurrency as property, meaning it is subject to capital gains taxes when sold or traded. However, the IRS also requires American citizens to report all foreign financial assets, including cryptocurrency, on Form 8949. This can be a complex and time-consuming process, and many Americans are unaware of these requirements.

“The IRS is taking cryptocurrency tax evasion very seriously, and Americans who fail to report their crypto gains could face significant financial consequences.”

Qualitative data:

A recent survey by US Tax Help found that over half of American cryptocurrency investors are unsure of how to report their crypto gains on their tax returns.

Many Americans are also unaware that they are required to report crypto gains even if they are held or acquired outside of the United States.

Quantitative data:

The IRS estimates that 17% of Americans underreported their crypto gains by over $10 billion in 2022.

The average fine for failing to report crypto gains is over $10,000.

Lack of Awareness

〰️

Complex Filing Process

〰️

Fear of Penalties

〰️

Lack of Awareness 〰️ Complex Filing Process 〰️ Fear of Penalties 〰️

Americans fail to file their crypto taxes due to a lack of awareness, the complex filing process, and fear of penalties.

Lack of awareness: Many Americans are simply unaware that they are required to pay taxes on their crypto gains.

Complex filing process: The process of filing crypto taxes can be complex and time-consuming, especially for those who are not familiar with cryptocurrency or tax law.

Fear of penalties: The IRS has imposed hefty penalties on taxpayers who fail or improperly file their crypto taxes, which can deter some people from filing even if they are aware of their obligations.

Competitive Analysis

H&R Block's top Competitors and Key Features

Empathy

Understanding User Struggles: A Deep Dive into Crypto Taxation

Survey: To understand our users' needs and pain points, we conducted a user survey, user interviews, and usability testing.

The survey was answered by 100 users who had filed crypto taxes in the past year. The survey asked about their experiences with filing crypto taxes, their pain points, and their preferences for filing crypto taxes.

The complexity of crypto taxes

The lack of clear guidance from the IRS

The cost of professional tax preparation

User Interview: The user interviews were conducted with 10 users who had filed crypto taxes in the past year. The interviews were semi-structured and allowed us to delve deeper into the users' experiences and pain points.

Questions we asked our users:

How do you estimate the value of your cryptocurrency holdings?

Have you ever made an error in filing your crypto taxes? If so, what was the error, and how did it affect you?

What are your biggest pain points when it comes to filing crypto taxes?

What are some of the challenges you face in tracking your crypto transactions?

What are your thoughts on using crypto tax software or hiring a professional tax preparer to help you file your crypto taxes?

User Persona

Inside the H&R Block Experience: A User's Lens

Using data from surveys and interviews, we've created a persona representing the typical H&R Block user, highlighting their needs and experiences with the platform.

User Empathy Map

User flow

Mapping Out Our Users’ Footsteps

This is the flowchart of the user journey through the DIY app to the CoinTracker Landing page app.

Screen Design

A Look At Our Mobile and Desktop Screens

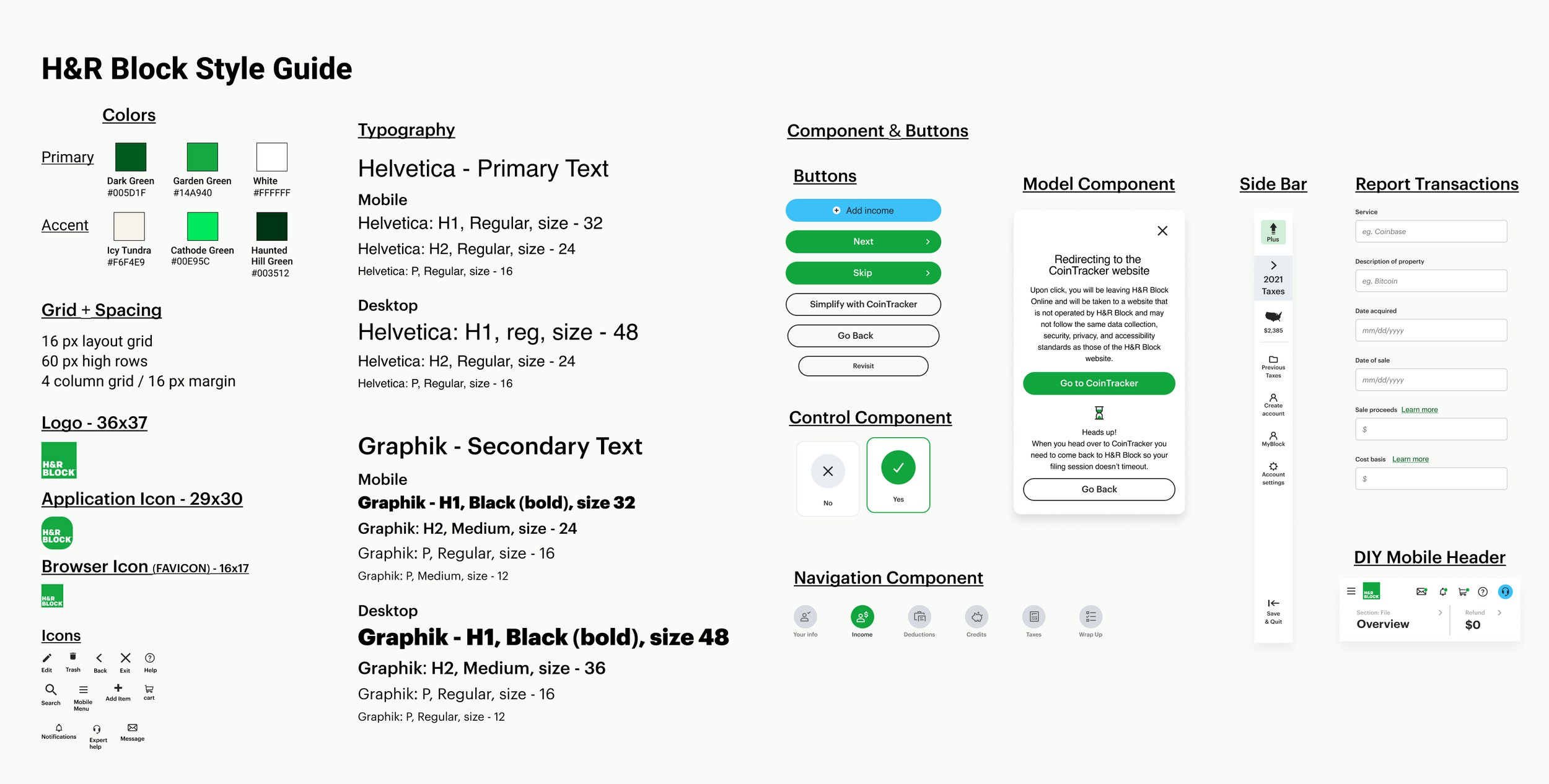

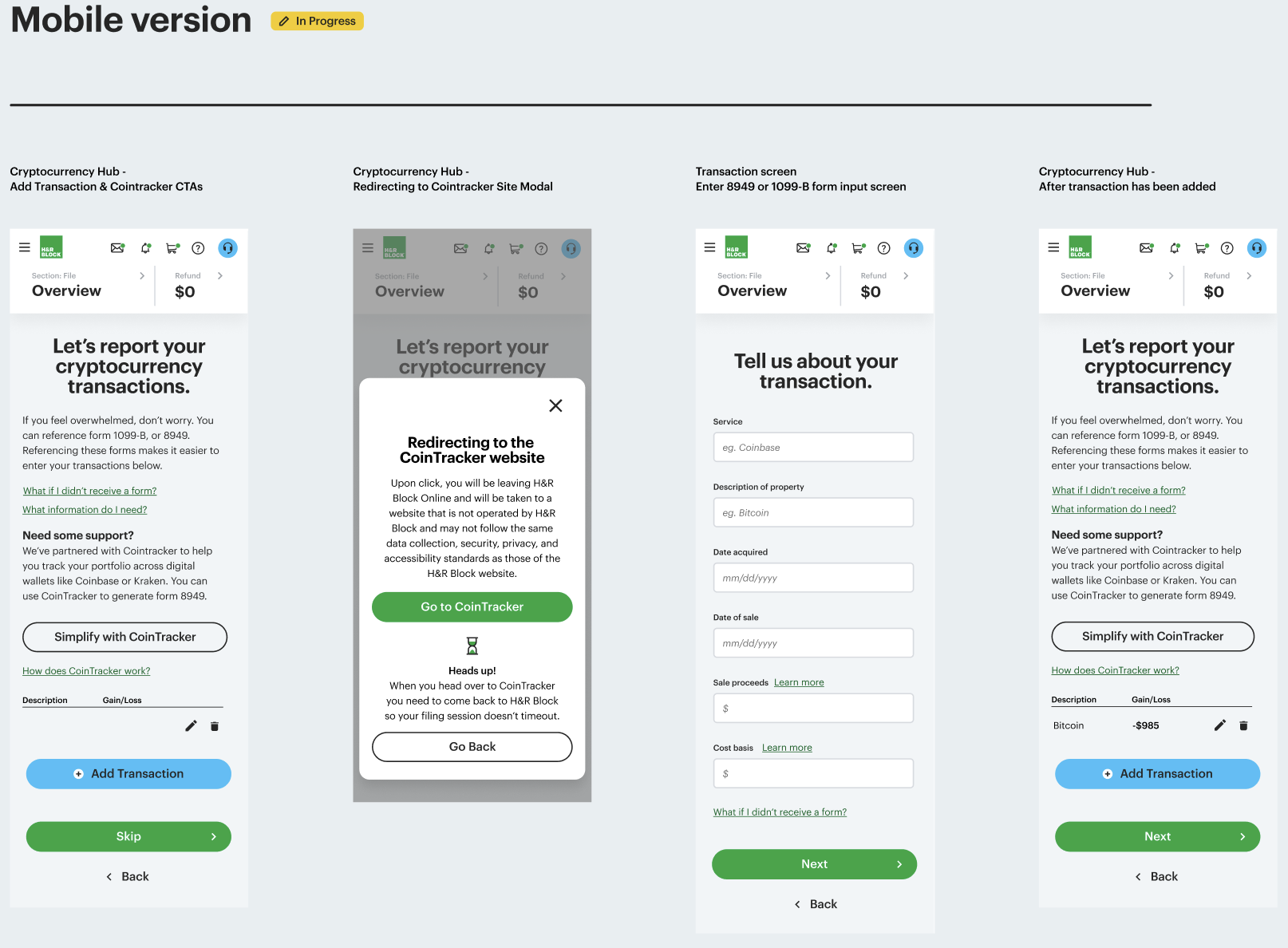

Our team created these high-fidelity screens using H&R's design system and following strict guidelines, as their DIY product was already live. Due to the tight deadline and developer constraints, we couldn't add too many new elements to the product. However, we did create the three main elements required for the app: the "Simplify with CoinTracker" CTA, the redirecting CoinTracker modal, and the Skip CTA.

The pre-defined brand colors, iconography, and typography instantly established consistency and brand identity. The reusable components like buttons, input form fields, and navigation bars streamlined development, allowing users a clear path to Corntracker’s 8949 form.

Mobile Screens

The mobile screen layout of a cryptocurrency hub, with CTAs to add transactions and connect to Cointracker, transaction input screen, and after-transaction screen.

Desktop Screens

Desktop screen layout of a cryptocurrency hub, with CTAs to add transactions and connect to Cointracker, transaction input screen, and after-transaction screen.

Prototype

Try our new H&R Block prototype to easily file your crypto taxes with CoinTracker!

Final results

H&R Block and CoinTracker Partner to Simplify Crypto Taxes

In the first phase of the H&R Block-CoinTracker partnership, we developed a solution to consolidate users' crypto portfolios into the 8949 form. This was the immediate problem that needed to be solved for the current tax season. As a contract employee, I was unable to participate in the test study for this feature, but the product manager and stakeholders agreed that the solution we created was successful.

Key Takeaway

Key Takeaways from the Project

Through my involvement in the H&R Block and CoinTracker partnership, I garnered invaluable insights and experiences. Here’s what I learned and how I intend to apply these lessons to future projects:

The importance of collaboration: This project required close collaboration between the H&R Block and CoinTracker teams, as well as with the content writer and project manager. I learned that it is essential to have open lines of communication and to be willing to compromise in order to achieve a common goal.

The need for flexibility: Things don't always go according to plan. When working on a tight deadline with limited resources, it is important to prioritize the most critical features and be flexible enough to adapt to changes.

The value of user feedback: We conducted user surveys and interviews to understand the needs and pain points of our users. This feedback was invaluable in helping us to design a solution that was both user-friendly and effective.

I am grateful for the opportunity to have worked on this project and to have learned so much from it. I will use the lessons I learned to improve my work on future projects.

For more work inquiries, or if you'd like to grab a coffee and chat, feel free to email me at wnoelux@gmail.com ☕️✨

Thank you for reading! 🧠